Michigan Automated Tax Payment System Worksheet

All future Sales Use and Withholding payments should be made online with our Michigan Treasury Online Website. For timely receipt of your payment the payment detail must be entered to the Automated Tax Payment System by 9 pm.

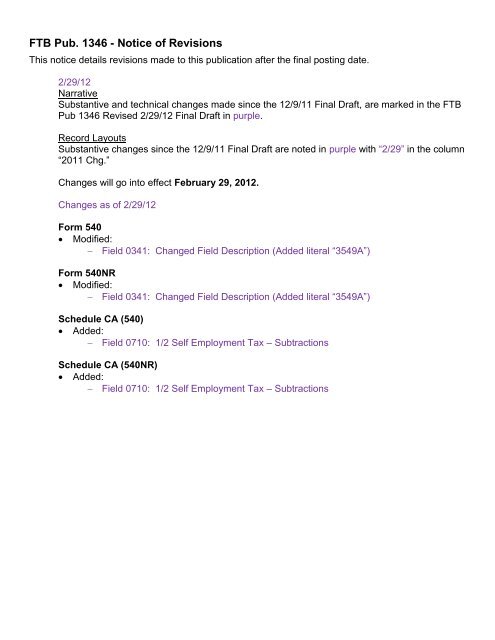

Ftb Pub 1346 California Franchise Tax Board State Of California

You can also pay your taxes online at Official Payments Corporation.

Michigan automated tax payment system worksheet. 5099 2020 SUW 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet 2019. Verify information on Form 4926 Is accurate and complete. Please keep a copy of the completed worksheet and confirmation number received for your files.

Quarterly Payments Worksheet. ET at least one business day prior to the due date. Pay your Michigan taxes quickly and conveniently 24 hours a day 7 days a week.

If you have an automated payroll system use the worksheet below and the Percentage Method tables that follow to figure federal income tax withholding. July 19 2018 was the last day to make electronic ACH payments in the current system. You can even schedule tax payments up to 90 days in advance.

5 Follow the screens through the process. EFTPS resources online and available for order by phone. Pay your City taxes quickly and conveniently 24 hours a day 7 days a week.

File pay and manage your tax accounts online - anytime anywhere. The Michigan Automated Tax Payment System is the system used to complete payments using Electronic Funds Transfer EFT. Paper checks will be accepted.

Treasury is committed to protecting sensitive taxpayer information while providing accessible and exceptional web services. Employers will increase withholding by the per pay period tax amount on Step 4c. Amount of wages subject to income tax withholding by the annual amount shown on Step 4a and reduce the an-nual amount of wages subject to income tax withholding by the annual amount shown on Step 4b.

More electronic and other payment options on the main payments page. Welcome to Michigan Treasury Online MTO. The tool will then automatically display the correct amount of federal income tax to withhold from that employees pay.

Visa MasterCard Discover Network and American Express credit and debit cards and other forms of payment such as Bill Me Later are accepted. VRS EFTPS-Direct Payment Worksheet long form continued Further breakout for the following tax forms. For timely receipt of your payment the payment detail must be entered to the Michigan Automated Tax Payment System by 9 pm.

ET at least one business day prior to the due date. Information into the Michigan Automated Tax Payment System EFT Debit by 9 pm at least one business day prior to the payment due date. 4 Select the date you want your payment to be received.

Complete Form 5099 before filing your return on MTO. Touchtone phone payments can be made by calling 1-877-865-2860. Publication 966 Electronic Federal Tax Payment System A Guide to Getting Started PDF.

1 0 Fortimely receipt ofyour payment it j is necessaryto enterthe payment information into the Michigan Automated Tax Payment System EFT Debit by 9 pm at least one business day prior to the payment due date. Pay your taxes online at the Online Michigan Automated Tax Payment System for EFT and Debit Payments. A user identification and password is required.

SUW 4 and 6 MonthlyQuarterly Return and Amended MonthlyQuarterly Return Worksheet. You can even schedule tax payments up to 90 days in advance. This method also works for any amount of wages.

To make an online payment go to wwwMichigangovbiztaxpayments. More information about the Income Tax Withholding Assistant for Employers the redesigned 2020 Form W-4 and other tax topics of interest to employers and small businesses can be found on IRSgov. For Tax Form 941 and CT1 you are requested to report.

EFT Credit Process. 5099 2019 SUW 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Payment Worksheets are available on Page 12 of this Booklet.

Pay your taxes online at the Online Michigan Automated Tax Payment System for EFT and Debit Payments. For Tax Form 720 you are requested to report IRS numbers and amounts and the IRS number amounts must balance to the Tax Form 720 payment amount. Michigan Automated Tax Payment System Worksheet Go to wwwmichigangovbiztaxpayments or call 1-877-865-2860 to enter your payment detail You may photocopy this blank worksheet to use for future payments.

All Michigan Individual Income Tax filers may choose to make a payment using a debit or credit card. Once accepted youll get an EFT Acknowledgment Number as your receipt. You can also pay your taxes online at Official Payments CorporationVisa MasterCard Discover Network and American Express credit and debit cards and other forms of payment such as Bill Me Later are accepted.

Effective May 272015 this State of Michigan Electronic Payment System Payconnexions link for Sales Use and Withholding SUW will be disabled. Publication 4990 EFTPS Payment Instruction Booklet for Business and Individual Taxpayers PDF. 3 Select the tax form payment type tax period and amount and subcategory information if applicable.

Credit card payments will be assessed a convenience fee of 235 of the total payment amount. EFTCredit Process o Whatto do when selecting EFT Credit. New employee fails to furnish Form W-4.

Debit card payments will be charged a flat fee of 395. MTO is the Michigan Department of Treasurys web portal to many business taxes. 1 Record the Confirmation Number you receive.

Percentage Method Tables for Automated Payroll Systems. To avoid penalty and interest they must be postmarked by July 20 2018. Michigan Automated Tax Payment System Information Introduction.

This method works for Forms W-4 for all prior current and future years.

Https Www Michigan Gov Documents Taxes 1040 Book 372115 7 Pdf

Https Tax Idaho Gov Pubs Epb00754 06 01 2020 Pdf

Federal And State Payments Electronic Funds Withdraw Setup

Https Www Michigan Gov Documents Taxes Suwe Filehandbook 478349 7 Pdf

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Never Used An Interactive Teller Machine Before No Worries We Got You Covered Interactive Teller Machines Or Credit Union Federal Credit Union Interactive

3 11 13 Employment Tax Returns Internal Revenue Service

Https Forms In Gov Download Aspx Id 2941

Https Dor Mo Gov Forms Mo 1040 20instructions 2018 Pdf

Sales And Use Tax Regulations Article 3

Financial Statement Personal Example 5 Ways Financial Statement Personal Example Can Impro Personal Financial Statement Financial Statement Statement Template

Short Sale Vs Foreclosure Simple Facts Foreclosures Mortgage Tips Shorts Sale

Http Revenue Ky Gov Forms 2010740npinstr Final 110410 Pdf

Https Tax Ohio Gov Portals 0 Forms Ohio Individual Individual 2009 Pit It1040 Instructions Pdf

Https Tax Ohio Gov Static Forms Ohio Individual Individual 2001 1040 2001 Bklt Internet Rev Pdf